Feature

Life insurance quote engine software for growth-minded agents

Streamline the quoting process, improve client experience, and close more deals.

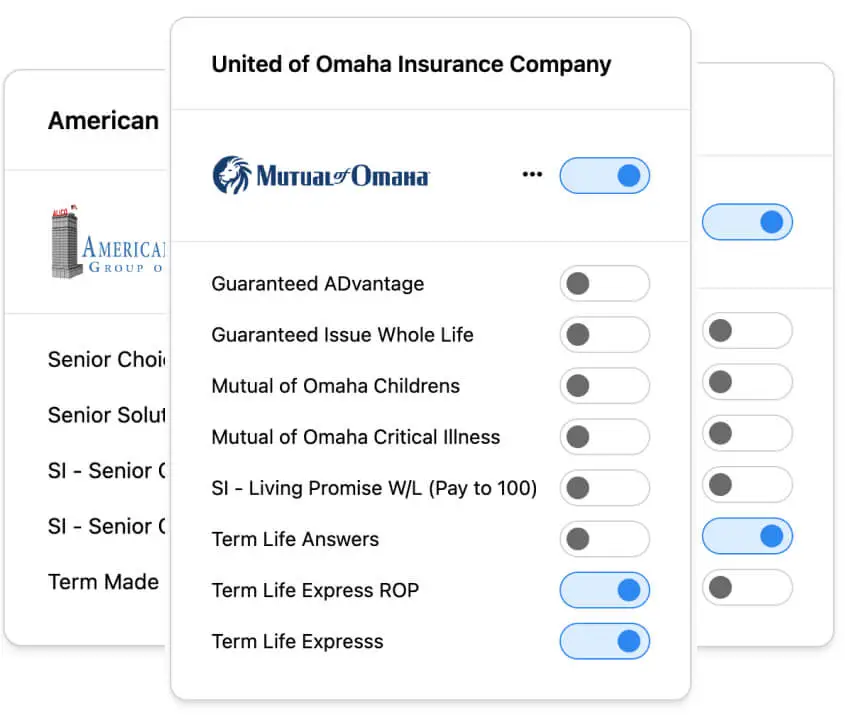

Choose which carriers & products you want to quote

Quote the carriers and products you want from dozens of top-rated options. Is your favorite company missing? We’ll gladly add it for you! The power is in your hands.

- Quote the products you want

- Don’t get backed into limited corner

- Over 40 carriers and 300 products to choose from

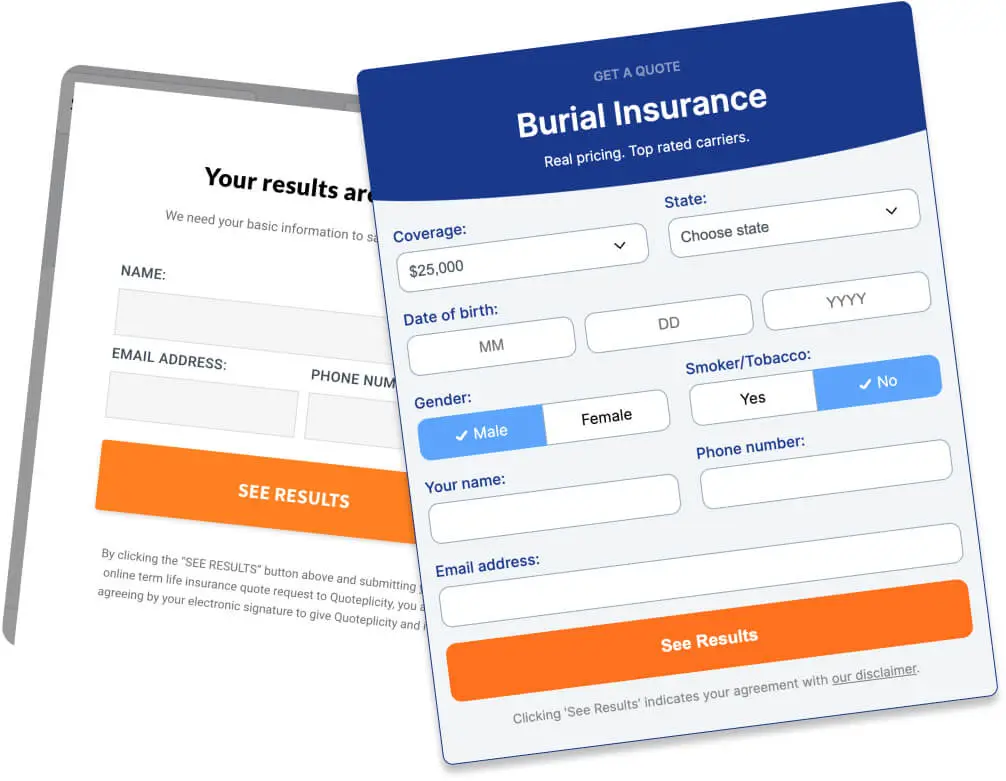

Choose when to collect personal information

Enhance your website conversion rate with drop-in ready widgets.

Choose from pre-made designs or build your own.

- Enhance conversion rates on your website

- Customize widgets to your own wants and needs

- No complicated coding required

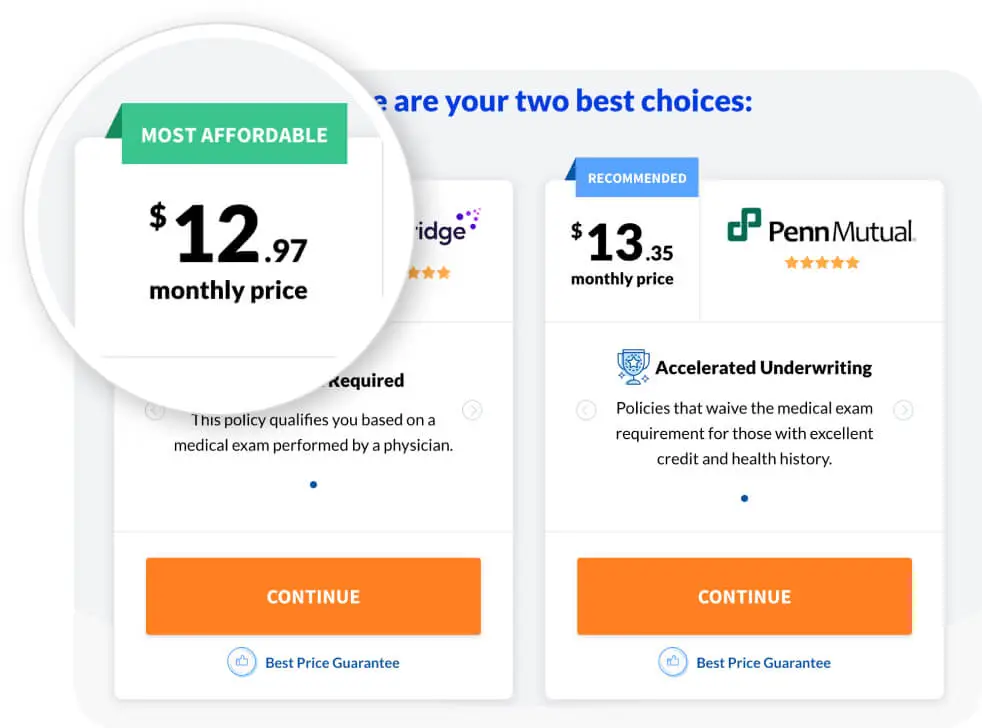

Simplify decision making

Guide your clients towards choosing a product. We’ll automatically highlight the most affordable product. The recommended product is entirely up to you.

- Simplify decision making

- Highlight a result based on your preference

Cloud based solutions

No software to download or complicated server setups to deal with. Enjoy the convenience of accessibility anywhere, anytime.

- Prevent high development costs

- Prevent maintenance fees

- Accessible from anywhere

We make it easy to get started

Branding

Upload your logo and avatar, link to your reviews, and customize the color scheme to align with your brand.

CRM integration

Integrate seamlessly with your CRM and website. Installation is straightforward—simply copy and paste a line of code when you’re ready.

Frequently asked questions

Does a customer have to enter in their personal information to run a quote?

The decision is entirely yours. The key information that transforms a lead into a customer includes their name, email, and phone number—what is known as Personally Identifiable Information (PII). You have the option to collect this information at the beginning of the quoting process, just before displaying the results, or not at all, allowing customers to run quotes anonymously.

Can additional products be added to your system?

Yes, if we can’t find the quotes or rates for your specific requested product through our available APIs, we can add products to our system database.

To do so, we need access to marketing materials, rate tables, build charts, and premium calculation equations, all of which are typically available through the insurance company’s sales or underwriting departments.

We can add your preferred products and carriers to our system at no additional cost.

Does the quoter come in other languages?

We’re glad you asked! Our quoting tool is also available in Spanish, with all content meticulously translated. If needed, we can customize any of the translations according to your specifications.

Additionally, we offer translation services for other languages as part of a custom project, available upon request.

How do you keep the rates accurate and current?

We utilize a third-party service dedicated to real-time synchronization with insurance companies. This ensures that any changes made by the companies are instantly reflected in the rates Quoteplicity provides.

What kind of products and categories can be quoted?

The advantage of our system is its flexibility, allowing you to create multiple quote engines and select which companies and products to display.

Our system is pre-built with 10 different quote engines, including:

- Term life insurance

- No medical exam term life insurance

- Instant issue term life insurance

- Living benefits term life insurance

- Accidental death insurance

- Final expense life insurance

- Guaranteed issue life insurance

- Whole life insurance

- Universal life insurance

- Children’s life insurance

Do I have to contract with Quoteplicity or a certain general agency?

No, Quoteplicity is designed as a versatile tool for independent agents and agencies, allowing you to quote any product from any company you choose. Our revenue is generated through a subscription model.

You have the freedom to contract with anyone you prefer. Quoteplicity is a valuable addition to your toolkit, aimed at helping you expand your business.

Do you offer other insurance types besides life insurance?

Currently, we only offer life insurance, but we are excited to announce that we will soon be expanding our services. Our upcoming launches include:

- Medicare Supplement Quoter with Medicare Add-ons

- Indexed Universal Life Example Quoter

- Fixed Annuities

- Indexed Annuities

- Disability Insurance

- Critical Illness Insurance

- Cancer Insurance

These new offerings will allow us to better meet the diverse needs of our customers.

Do you have any products that can be sold completely online without an agent?

We have the capability to direct customers to any URL you specify. If you have a product you’d like us to quote, we can seamlessly send that customer to your agentless application.

Currently, our customers are quoting products from Ethos, Assurity, and Sproutt, and we are planning to expand our offerings to include more options for agentless and instant issue life insurance products.

Please note that at this time, we serve solely as a quoting platform. It is your responsibility to set up your custom agentless applications.

Do you offer CRM services such as email?

Do you offer lead distribution services?

No, as leads are generated, they are stored in the Quoteplicity portal and then sent to you, the customer, via email and API or synced to your CRM or lead management software.

What if I have additional questions?

If you have any questions or feedback, please don’t hesitate to call us at (602) 902-1072, send an email to [email protected], or schedule a one-on-one meeting. We are here to answer all your questions and listen to your feedback.